Do you know to create a budget and stick on it, is a critical skill in both personal life and for business. Creating and using a budget is a key component in driving your business successfully. Because a good budget has a great impact on your overall business operations. A budget is a financial plan for the future concerning the cost of business. And it outlines your organization’s financial goals.

Table Of Content

Budgeting Tips For Your Business

- Some Budgeting Tips for Your Business

- What is the Key to a Successful Company Budget?

- Budgeting Strategies for Businesses

- How do you Prepare a Business Budget?

- How to Make a Monthly Budget?

- How to Manage a Budget in Business?

- Business Budgeting (Planning)

- How to Prepare Annual Budget for a Company?

- Business Budgeting 101: Successful Budgeting Rule

- Benefits of Budgeting in Business

- Simple Budgeting Tips

- Budgeting Calculator

- Personal Budgeting Tips

A budget helps to achieve financial goals.

Create a budget and stick to it. The most effective way to budget for a business is to overestimate your expenses.

Create a zero-based budget because it forces you to reevaluate every expense against your business strategy.

Involve your employees because budgeting for business is responsibility that falls on one person’s shoulders. An ideal budget is created by team of employees with diverse set of skills to manage the business budget effectively.

Keep an eye on your sales cycle as, many businesses face slow progress. You have to account for your expenses during the break time. Use this break time to increase market sales.

Review your business budget on an interval of time or every few months and shop for new suppliers to save money on the services of your business.

Try to save a portion of your profit that you earn and never skip it. Because saving helps in an unpredictable expense that can’t be expected.

Tally your income sources and starts with your sales figure the add other income sources that you used to run your business.

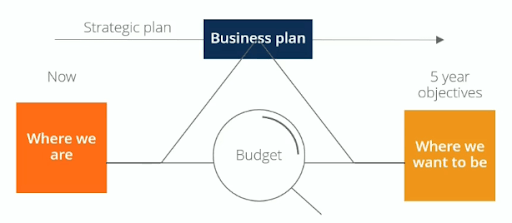

Once your business starts it is essential to plan a budget and manage it tightly. Creating a budget is the most effective key to keep your business and its finance on track. Some other key components for a successful company budget.

Business Income

Company Expense

Net Income and loss

Overhead & Production

Project Annual Performance

A business can use its budget to stay on its financial goals. Business strategies set the main focus of the budget as budget goals.

Identify what financial objectives your business wants to achieve the goals.

A budgeting process starts by setting a profit expectation and then work forward to achieve them.

Work on creating growth based budget strategy when business turns its focus from profit to growth.

Focus on cost control budget if the business is in financial trouble, cut every possible cost.

How do you prepare a business budget?

Create a business budget in the following ways-

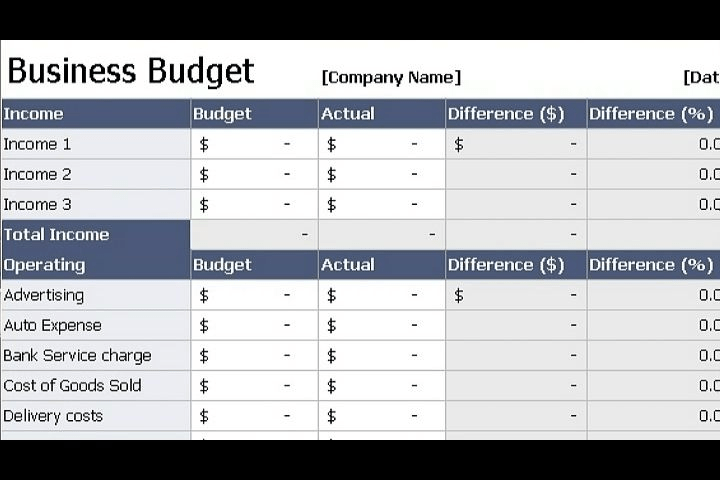

The first thing about the good business budget is come to know that how much money you bring in a month. Start your sales i.e. profit or loss and then add further income sources you use to run the business.

Determine fixed costs, that are charged the same price each month and include all the variable expenses.

Predict one-time spend money, some spending's may come up unexpectedly like computers, laptops, furniture, software, office supplies, gifts.

Take it all together and take action with a checklist so you can create an effective budget without hassle.

Business Budgeting

A business budget helps you to determine the money you have for fund operations, expand & generate income. Without a budget, the organization or business runs at the risk of spending money. Always keep in mind to not spend enough money to compete with others.

You can manage a budget in the following ways-

The first step in any budgeting exercise is to examine and calculate revenue, not profit. Revenue is all the money that comes in business before the expenses of the organization deducted. Determine variable expenses such as the owner’s salary, office supplies, professional development, marketing cost, utilities. Set aside some emergency funds for unexpected costs and then create your profit and loss statement.

Preparing an annual budget for a company a key financial management tool.

You can start your annual budget by viewing the profit and loss statements. Review each category in the annual budget in detail. Be realistic with the annual budget because the annual budget for the company becomes ineffective if they are filled with hope only. Add your annual budget in the financial system of the company, take the annual budget and divide it by month and in this way it becomes a pro forma profit and loss statement for the upcoming year.

A successful budget is created by the following rules that helps to create a successful budget.

Rules:

Decision-Making Tool

Management Tool

The Plan

Problems Exist

Problem Solving Tool

There are following other rules but these 5 rules are most effective for the business.

Benefits of Budgeting in Business

There are the following benefits of creating an effective budget for the company. The budget is the key or the estimate of income or expenditure for a period of time.

It helps to predict what will happen in the future, estimates revenue, plans expenditure and restricts any spending that is not part of the plan.

Budgeting helps to ensure that the money is allocated to the things that are beneficial for the strategic objectives of the business.

The business budget helps to manage your money, monitor performance to meet your objectives and improve decision making.

Some Good Budget tips to help you in your business:

Set a new budget for each month before the month begins.

Create a zero-based budget, it means add all the income sources, fixed expenses, monthly expenses.

Track every expense by using the “Takefin Finance and Expense Tracker App” to know where your money is actually going.

Understand the difference between needs and wants. Spend money on needs instead of spending on wants.

Review your spending habits, if you are spending more money at one thing then you have to spend less on another.

Use

Budgeting CalculatorThe budget calculator is mainly focused and evaluates the components of a personal budget and indicates that in what area you need to improve yourself in terms of spending money. The budget calculator is the planning of personal finance. 50,20,30 is the best way to spend your money.

Personal budgeting is the key to one’s successful financial goal. Everyone needs a budget in their lives to control or track the expenses. Here are some Personal budgeting tips:

Create a financial calendar

Track your net worth

Set a budget, period

Consider an All-cash diet

Allocate 20% of your income toward financial priorities

Budget 30% of your income for lifestyle spending

Keep your credit use below 30% of your total available credit

Make savings part of your monthly budget

Business & personal expenses tracker app

Tracking business and personal expense is not an easy task. To control and track your spending you need an app that helps you to know about your personal expenses. There are a number of apps are available on the store but you need to go with TakeFin Finance.

Takefin Finance a free personal Expense Tracker App is the best app that helps to monitor your spending's. This personal and business expense tracker app helps you to convert the financial data into digital records. This budget app is ideal for both household or personal finance tracking and business tracking too.

Read More: The 8 Best Personal Finance Apps of 2020